Ready to take the first step? Book a call with me and my team! We’ve helped hundreds of Swiss startup founders set up their convertible loans. With our expertise, data insights, and efficient process, you’ll get the best results!

Michele Vitali, Head of Startup Financing & VC, Partner @LEXR

As CLAs continue gaining traction in the world of start-ups and VCs, it is worthwhile to once more address this popular debt financing instrument and turn our attention to one important aspect that often gets overlooked: whether the CLA (or the conversion of the loan into equity) should be based on a pre-money or a post-money valuation.

Pre-Money vs. Post-Money: What’s the Difference?

While the pre-money valuation does not take into account the amounts invested under CLA(s), the post-money valuation reflects the valuation of the start-up including all amounts invested under the CLA(s).

This difference has an impact on the issue price (share price) the lenders pay upon conversion of the convertible loan (assuming conversion at the respective valuation cap, and not with a discount).

Calculating Share Price: Pre-Money CLA

In case of a Pre-money CLA, the issue price is calculated by dividing the Pre-Money Valuation by the sum of:

- all shares issued and outstanding immediately before the conversion; and

- all options to subscribe to (phantom) shares, whether vested/allocated or not, issued and outstanding immediately before the conversion

Calculating Share Price: Post-Money CLA

In case of a Post-money CLA, the issue price is calculated by dividing the Post-Money Valuation by the sum of:

- all shares issued and outstanding immediately before the conversion;

- all options to subscribe to (phantom) shares, whether vested/allocated or not, issued and outstanding immediately before the conversion; and

- all shares issued to the lenders upon conversion of their loans under the outstanding CLAs (usually prior to an equity financing round acting as “triggering event”).

It is important to note that in both instances the valuation cap does not include the shares issued to new investors in the course of the equity financing round immediately following the conversion of the CLAs.

Discover our convertible loan services

Interested in how our convertible loan services can support your startup’s financing needs? Visit our landing page to learn more about our flat fee package and simplify your financing process.

How Do Pre-Money and Post-Money CLAs Affect Ownership and Dilution?

Although the difference between the pre-money and the post-money valuation may seem purely technical, and while in both cases the CLA will typically convert into equity in the context of a subsequent equity financing round, the choice between pre-money and post-money CLA directly affects the shareholdings and share dilution of the founders and the lenders upon conversion—so it’s important to get it right from the start.

Let’s illustrate these effects:

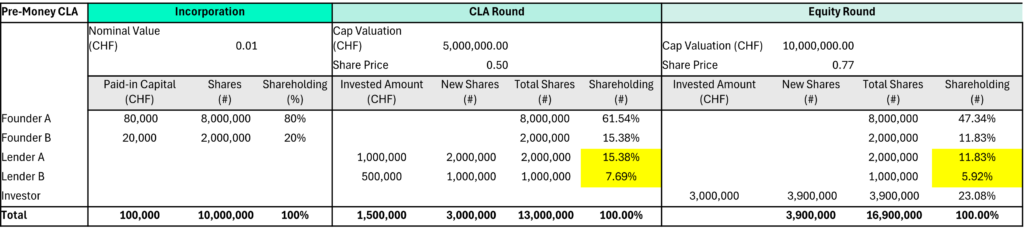

Example 1: Ownership and Dilution with a Pre-Money CLA

Under a pre-money CLA, Lender A invests CHF 1’000’000.00 and Lender B invests CHF 500’000.00 at a pre-money cap valuation of CHF 5’000’000.00. As there are currently 10’000’000 shares issued and outstanding, the share price amounts to CHF 0.50 (assuming conversion at cap valuation). Thus, Lender A will receive 2’000’000 shares (i.e. CHF 1’000’000 / CHF 0.50) and Lender B will receive 1’000’000 shares upon conversion.

Yet, at the time of the execution of the CLA and the disbursement of the loan amounts, Lenders A and B have no way of knowing the exact shareholding percentage they will receive for their loan upon conversion. This will depend on the size of the CLA Round, i.e. whether the start-up will enter into any further convertible debt financing instruments until the conversion, converting alongside the CLAs of Lenders A and B in the context of the Equity Round.

Assuming that the start-up does not grant any further CLAs in the CLA Round, the conversion of the CLAs immediately prior to the Equity Round results in shareholdings of 15.38% for Lender A and 7.69% for Lender B. Or in other words, the Lenders receive a total stake of 23.08% and the Founders are diluted to 76.92% by the conversion of the convertibles (not including the equity round).

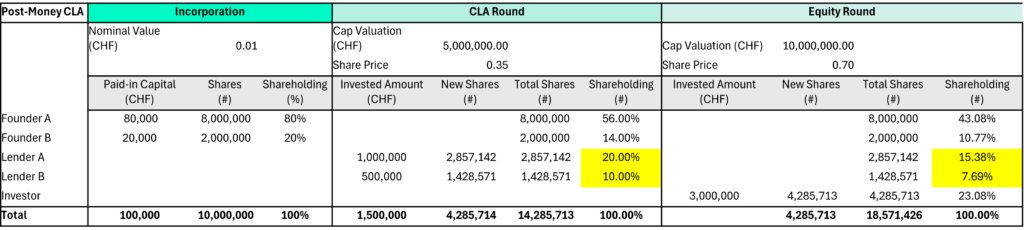

Example 2: Ownership and Dilution with a Post-Money CLA

Let’s take the same example but assume that Lenders A and B invest under a post-money CLA: For its investment of CHF 1’000’000.00 at a post-money cap valuation of CHF 5’000’000.00, Lender A will hold a shareholding of 20% (CHF 1’000’000.00 divided by CHF 5’000’000.00) post-conversion, irrespective of whether the company might further expand the CLA Round.

Equally, Lender B will hold a shareholding of 10%. The most important variable in post-money CLA negotiations will, therefore, be the valuation cap, which will affect not only the share price but also the ownership of the lender in the company post-conversion.

As can be seen from the table below, the additional shares distributed to Lenders A and B (as opposed to the situation under the pre-money CLA) are due to a lower share price (CHF 0.35 instead of CHF 0.50), as not only the currently issued and outstanding number of shares of the start-up are taken into account when calculating the share price, but also the 4’285’714 newly issued shares to Lenders A and B upon conversion (i.e. CHF 5’000’000 divided by 14’285’714).

Consequently, the Founders’ shareholdings post-conversion are lower in comparison to the pre-money CLA scenario, illustrating that any additional funds raised in a post-money CLA setup only dilutes the founders, while the stake of the lender remains fixed at “Investment Amount / Post-Money Valuation”. A post-money CLA is therefore “closer” to an independent financing round which incentivises the founders to think about the dilution if they issue additional CLAs.

It is also worth noting that in both instances, i.e. irrespective of whether a pre-money or a post-money CLA is chosen, the dilutive effects of the subsequent Equity Round are the same, i.e. Founder A, Founder B, Lender A and Lender B are equally diluted by the Investor.

Key Takeaway: Which CLA is Right for Your Startup?

The general advantages of CLAs, including time and costs, have been discussed in earlier blog posts and hold true for pre-money and post-money CLAs alike.

- Pre-money CLAs provide for an equal distribution of the dilution effect among founder and investors but leave uncertainty about the final ownership percentages until conversion.

- Post-money CLAs provide clarity regarding the ownership structure post-conversion, whereby the dilution effects are solely borne by the founders, motivating them to carefully consider additional CLAs.

Both options share the advantages of simplicity, lower costs, and speed compared to traditional equity rounds.

Ultimately, the choice depends on your startup’s needs, investor expectations, and your plans for future financing.