Ready to take the first step? Book a call with me and my team! We’ve helped hundreds of Swiss startup founders set up their convertible loans. With our expertise, data insights, and efficient process, you’ll get the best results!

Michele Vitali, Head of Startup Financing & VC, Partner @LEXR

After focusing on the Employee Share Ownership Plans (ESOP) in our last blog articles, we will now take a closer look at the Phantom Share Ownership Plan (PSOP) in Switzerland. In this article, we will cover (i) the similarities between a PSOP and an ESOP and (ii) how the process of pay-outs to participants typically works. After that, we will look at (iii) the advantages of a PSOP over an ESOP and (iv) the tax consequences for the participants.

Phantom Shares

Similarities to the ESOP and setup

In short, the key difference to an ESOP is that the participants of the PSOP do not become shareholders of the company. Instead, they receive a contractual right to receive a cash payment upon the occurrence of certain trigger events, typically the sale or the IPO of the company. The financial participation of the participants is modeled on that of shareholders. For this reason, the participants under a PSOP are commonly referred to as phantom shareholders.

A PSOP allows the company to let employees participate in the monetary gains of the company as if they were shareholders without giving out actual shares. The employees participate virtually in the company. This also means that the shareholder structure is not changed by a PSOP. Nevertheless, the adoption of a PSOP, like the ESOP, has a dilutive effect on existing shareholders (see section 1.2). Although not mandatory under Swiss corporate law, it is therefore recommended to obtain the consent of existing shareholders before introducing a PSOP.

The setup of the PSOP is very similar to the ESOP. The two core documents are:

- The plan – here all details regarding the employee participation are unilaterally defined by the company; and

- the allocation agreement – this allocates the options or phantom shares to the participant and in return, the participant agrees to be bound by the plan (and to pay a price for the options/phantom shares if provided for in the plan).

As with the ESOP, the plan addresses the following key issues in particular:

- Eligible participants: Who can participate in the plan (e.g. employees, board members, and advisors).

- Size of the option pool: The maximum number of phantom shares to be issued (e.g. 5-20% of the current share capital).

- Exercise price: The hypothetical price participants pay to be allocated phantom shares – phantom shareholders do not actually have to pay anything, the exercise price will simply be deducted from the pay-out at the trigger event.

- Vesting schedule: With a vesting schedule, the phantom shares have to be earned over time by the participants. Once vested, phantom shareholders retain the right to the benefits even if they leave the company. Upon the occurrence of a liquidity event, the vesting usually ‘accelerates’ and all phantom shares will entitle to a pay-out.

- Forfeiture of the phantom shares (bad leaver): Upon the occurrence of certain events, all phantom shares are forfeited. Typically such events are a breach of a non-compete provision, termination of the employment contract for cause, or criminal acts against the company (a so-called bad leaver).

Since the participants do not become shareholders of the company, the allocation of the phantom shares is simplified. This means in particular that no meeting with the notary for the formal capital increase is required.

The events that trigger a payment to the phantom shareholder are referred to as liquidity events. Typically, these are any events where the shareholders receive cash, particularly (i) an EXIT (a sale of all shares, all assets, an IPO, or a merger) or (ii) a dividend distribution.

Pay-out to phantom shareholders

The claim of the phantom shareholders typically represents a contractual obligation of the company towards the participants. In the case of an EXIT, this liability is taken into account by the buyer when negotiating the purchase price with the shareholders.

The plan may also provide that e.g. the founders are liable for the claims of the phantom shareholders. In this case, the phantom shareholders do not have to be taken into account by the buyer and only the founders are diluted by the phantom shares.

In the simplified example below, the plan is funded by the company and the shareholders have negotiated a valuation of the company of CHF 5 million, equalling a purchase price of CHF 50 per share. However, this amount is reduced due to the company’s obligation to pay the phantom shareholders. Assuming a strike price for the phantom shares of zero, the purchase price paid to the shareholders is reduced by the liability of the company towards the phantom shareholders as follows:

| EXIT price for the company | CHF 5’000’000.00 |

| Number of common shares | 100’000 |

| Price per share | CHF 50.00 |

| Number of phantom shares | 20’000 |

| Strike price per phantom share | CHF 0 |

| Total number of shares (common plus phantom) | 120’000 |

| Adjusted price per share/phantom share | CHF 41.70 |

| Liability of the company towards the phantom shareholders (adjusted price x phantom shares) | CHF 833’333.33 |

In such a liquidity event, the phantom shareholders are economically treated as if they had been shareholders and receive the same amount of money per phantom share as the shareholders per share. As in the example above, the simplest and most common solution is to have the company be liable for the payment.

Discover our ESOP/PSOP solutions

Find out how we can help you implement successful participation plans while ensuring compliance with Swiss regulations.

Advantages over the ESOP

From the company’s point of view, phantom shares have an advantage over the traditional ESOP in that the participants do not receive any information or participation rights. They merely participate economically in the success of the company. In addition, a PSOP is set up comparatively quickly and easily in contrast to an ESOP, since there are no corporate actions involved and the tax consequences, while not always ideal, at least are straightforward.

Phantom shares are a purely contractual obligation of the company towards the participants. Compared to the issuance of real shares under an ESOP, such a plan can be easily administered and there is no need for a tax ruling or an annual capital increase with a visit to the notary.

On the other hand, the outstanding phantom shares represent a liability of the company, which must be monitored by the company and taken into account when making payments to shareholders.

Tax (for Swiss residents)

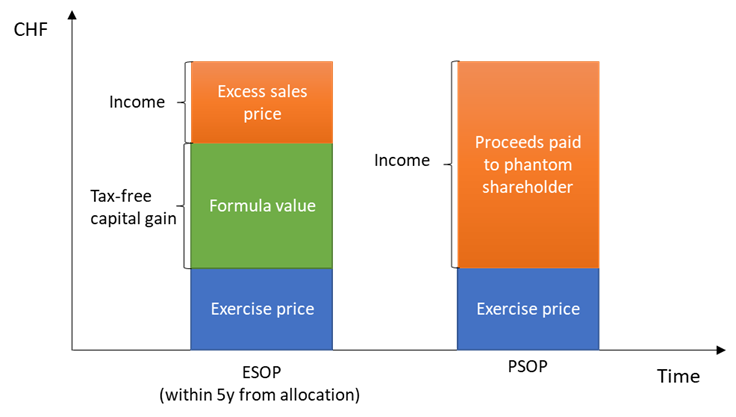

A phantom shareholder is not eligible for tax-free capital gains. Hence, the tax burden is usually higher than if they had received shares under an ESOP, as the entire proceeds, i.e. the entire pay-out, is taxable income for the participant and subject to social security contributions.

However, pay-outs from the PSOP are only taxed as salary components (plus social security contributions) in case of a liquidity event, which means that the participants have also received money on their bank accounts. Although there is usually a higher tax burden, the situation can be more welcoming for phantom shareholders. Employees who have received shares under an ESOP can find themselves in an uncomfortable situation as there can be tax liabilities already at the moment of exercising the options before there is a liquidity event. In such cases, they may have to pay high income and wealth taxes without having received sufficient funds to pay the taxes due to their low startup salaries. Please note that the tax consequences for the participants depend on the tax residency of the participants, not the company. Only a few countries allow tax-free capital gains so that the tax benefits of the ESOP for international participants are typically less pronounced than for Swiss participants.

Conclusion

A PSOP is very similar to an ESOP in many respects. In particular, the underlying plan is in many ways almost identical. Thus, the concept of vesting can also be applied to the PSOP to motivate and retain employees. The issuance of phantom shares, on the other hand, is simplified compared to normal shares, as no meeting with the notary for the formal capital increase is required. Furthermore, the participants do not formally become shareholders and thus, with the exception of the contractually replicated financial rights, do not receive any shareholder rights. For participants residing in Switzerland, the major disadvantage is usually that they cannot benefit from a tax-free capital gain on a sale, and any pay-out always becomes subject to income tax.

We know that each situation is unique, and we’re here to discuss yours in detail. Please don’t hesitate to book a free call with our experts. Let’s navigate the complexities of PSOPs together!