Ready to take the first step? Book a call with me and my team! We’ve helped hundreds of Swiss startup founders set up their convertible loans. With our expertise, data insights, and efficient process, you’ll get the best results!

Michele Vitali, Head of Startup Financing & VC, Partner @LEXR

In this last part of the Employee Participation blog series, we will give you a brief overview of the most important tax questions surrounding an Employee Share Ownership Plan (ESOP). It is important to remember that participants under an ESOP are either (i) directly allocated shares upfront with reverse vesting or (ii) are first allocated options that can be “exchanged” into shares at a later date.

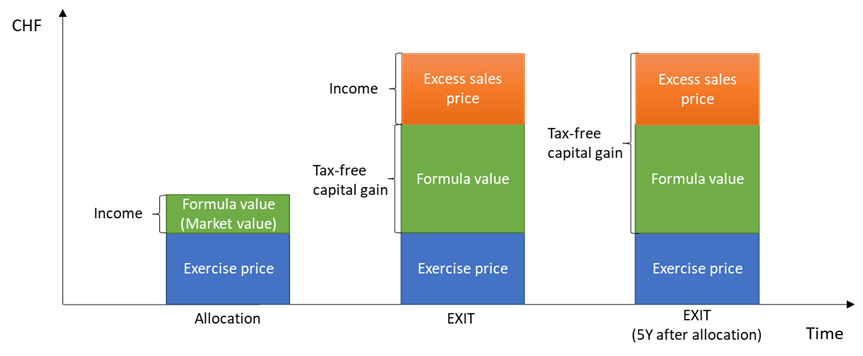

From a tax perspective, the granting of options is not yet tax-relevant. A tax consequence is only triggered when shares are transferred to the participant or when the shares are sold by the participant. This means that there are two tax-relevant moments:

- the allocation of shares; and

- the sale of the shares (EXIT).

Click the following link, if you want to find out more about the tax implications of a phantom stock option plan (PSOP).

ESOP – Tax

Taxable income: Under an ESOP, participants often receive shares below market value. From a tax point of view, the difference between the price participants pay to exercise the options and receive shares (can be zero) and the tax value of the shares qualifies as a monetary advantage for the employee, which is treated as taxable income and subject to social security contributions.

Tax ruling: To make the tax burden predictable and to select a valuation method that is more representative for start-ups, we always recommend getting a tax ruling in which the company agrees with the tax authorities how the company value, i.e. the market value for tax purposes, is to be determined (so-called formula value, e.g. EBIT multiple formula). This formula value is the relevant value for calculating income tax.

If no formula value is defined and the company has not yet achieved any significant profit, the tax authorities will use the net asset value (Substanzwert) of the shares or the so-called practitioners’ method (Praktikermethode), which is a weighted average of the net asset value (Substanzwert) and (usually) two times the capitalized earnings (Ertragswert), as formula value. Since these valuations usually do not increase significantly in the case of a high growth start-up until the exit, in the worst-case scenario a large portion of the sales proceeds could be taxable as income. Therefore, a valuation method such as an EBIT-multiple is agreed with the tax authorities that lead to a better representation of the increase in value.

Discover our ESOP/PSOP solutions

Find out how LEXR can help you implement successful participation plans while ensuring compliance with Swiss regulations.

Tax trap: Employees need to pay income tax upon the transfer of the shares. With the transfer, however, no money is paid to the employee. If the difference between the exercise price and the formula value is very high, this can lead to a high tax bill despite a low fixed cash income.

Blocking period: If the plan provides that employee shares (fully vested) cannot be sold during a certain period (blocking period), around 5.6% per blocking year up to a maximum of around 44% (i.e. 10 years blocking period) can be deducted from the tax value (i.e. formula value, if agreed) of blocked employee shares.

Tax-free capital gains: If the shares are held by an individual residing in Switzerland, the proceeds of the sale of shares qualify as so-called tax-free capital gains. However, within the first five years from allocation of the shares, this principle has limitations for employee shares. In the case of employee shares, only the increase in value within the formula (the difference between the formula value on sale and the formula value on transfer of the shares) is tax-free. The excess sales price is considered taxable income.

A comprehensive summary on the subject of taxation can be found in the information sheet of the Cantonal Tax Office of the Canton of Zurich (in German only).

Conclusion

Understanding the tax implications of an ESOP is crucial for both companies and employees to avoid unexpected tax burdens and to maximize the benefits of the plan. By proactively managing tax considerations, including obtaining a tax ruling and understanding the potential tax traps, companies can create a more predictable and favorable environment for employee participation.

If you need assistance navigating the complexities of ESOP taxation or setting up an ESOP tailored to your needs, we’re here to help. Book a free call with our experts to get started on optimizing your employee participation plan today.